PUSH ALERTS SO YOU'LL

NEVER MISS A MOMENT

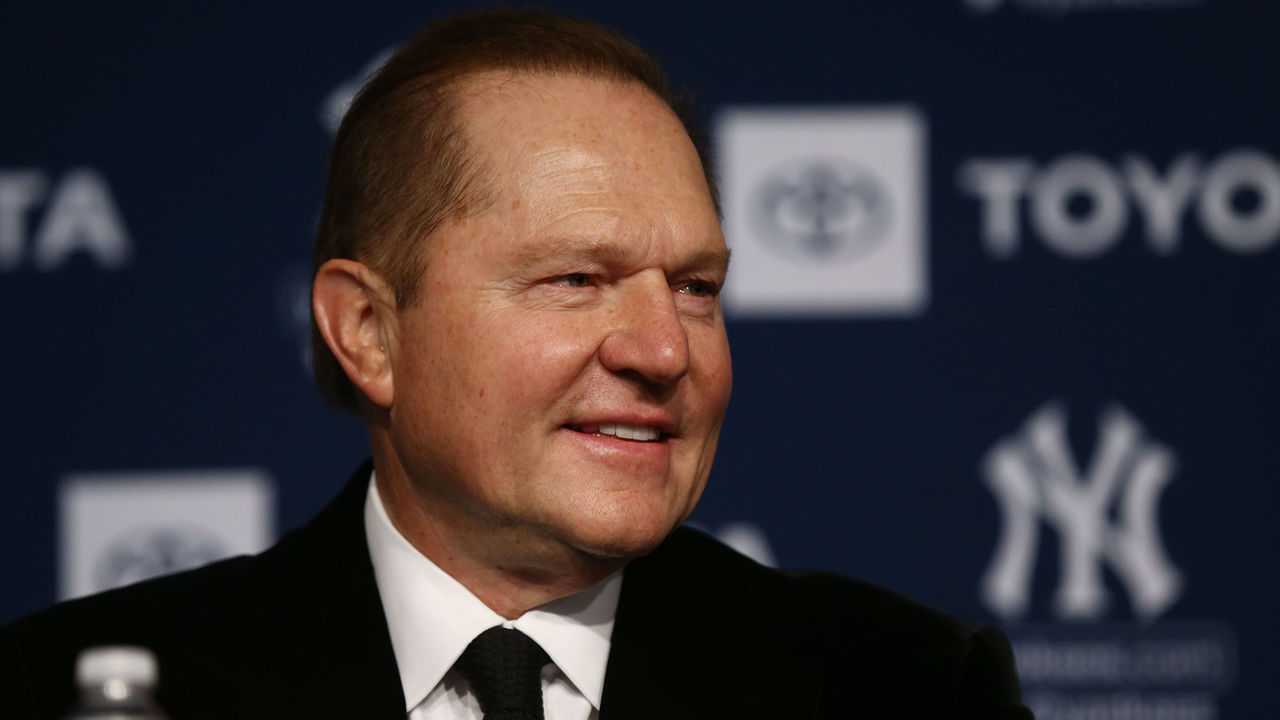

Scott Boras controls this offseason

One key subplot this winter transcends any specific player or team interest, instead centered around someone working behind the scenes - and occasionally in front of the cameras.

Uber-agent Scott Boras represents eight of the consensus top 20 free agents, and five at the top of the list: Juan Soto, Corbin Burnes, Alex Bregman, Blake Snell, and Pete Alonso.

Rarely does one agent have so much influence.

Last offseason, he represented a collection of stars known as the "Boras Five" - Snell, Matt Chapman, Jordan Montgomery, Cody Bellinger, and J.D. Martinez. This year's crop is even more accomplished.

How Boras advises his clients this offseason will determine which clubs win and lose in terms of roster improvement, and also whether he enjoys a personal bounce-back performance.

Boras isn't used to losing, but last winter represented one of the few Ls on his resume.

At the start of the offseason, FanGraphs' crowdsourcing predictions forecast the "Boras Five" would sign for a combined $466 million. Those players' actual contracts totaled just $233 million guaranteed.

That was a significant and rare miss for Boras, who'd been an outlier in terms of both signing clients to record deals in terms of total dollars and beating market expectations.

Macro-level factors, like the unraveling of the sport's cable TV ecosystem, were at play last winter. Local TV revenues account for about a quarter of team earnings, so that uncertainty likely played a role in reducing the amount spent by clubs, even in Ohtani mania.

Spending on free agency last offseason ($2.96 billion), was down nearly a billion dollars from the previous year ($3.9 billion).

"(Last offseason) 10 teams decided to lower their budgets from '23," Boras told theScore in March when asked about his clients' contract shortfalls. "There was a billion dollars taken out of the free-agent market.

"What I've done with players like Carlos Correa - when the markets are not there, we got him a three-year guarantee for about $100 million (in 2022). He took a contract with optionality (a first-year opt-out)," Boras explained. "The very next market, they were spending, and there was more demand for his services. He ended up getting a contract for $200 million with a chance to make an additional $70 million. He converted a situation with optionality into something that more than doubled the value (of the 2022 deal)."

Snell is pursuing a path similar to Correa's. He opted out of the deal he signed last March, when he was coming off winning the NL Cy Young Award, to test the waters again. (Snell and Boras turned down a $150-million offer from the Yankees last winter before settling for a shorter-term deal with the Giants.)

Bellinger, on the other hand, elected to remain with the Cubs for 2025. Not everyone trusts there will be a market rebound, and Bellinger is coming off a so-so campaign.

Perhaps the market conditions have improved. There's less uncertainty related to regional television deals, but many clubs have taken smaller payouts to stay with Diamond Sports Group now that it's exited bankruptcy. Others are striking out on their own in partnership with MLB.

It'll be interesting to see if Boras' approach is any different. He's certainly not lowering his initial demands.

Ken Rosenthal reported Boras is seeking a guarantee for Bregman north of $300 million, nearly double what FanGraphs expects ($162 million).

But the big question remains how long Boras is willing to advise his clients to wait, especially after irking Montgomery last offseason and losing him as a client.

Boras, historically, is comfortable playing the waiting game, and generally plays it well.

"People call me all the time and say, 'Man, your players aren't signed yet.' Well, it doesn't really matter what time dinner is when you're the steak," Boras said in 2013.

During the 2018-19 offseason, Boras client Bryce Harper, along with Manny Machado, were the last two under-26 stars to hit the open market before Soto. Machado and Harper didn't sign until after spring training camps opened. They became the first free agents to sign $300-million deals.

But they were steaks.

When that approach falters, players are squeezed. The melting offseason clock favors clubs more and more as spring training camps open.

Last winter, Montgomery was worth more than the one-year, $25-million deal with a $22.5-million option he signed with Arizona in late March. Public forecasts had him signing for more than $100 million. He blamed the late start to his preparation for his down campaign. After the worst year of his career, he exercised the option rather than hit free agency again.

Montgomery later fired Boras and told the Boston Herald he felt Boras "kind of butchered" his free agency.

There was a lot of squeezing in the market last offseason, in part because of Boras.

The first 60 days of last offseason featured 44 free agent signings, well short of the previous 10-year average of 58.7. The guaranteed number of seasons awarded (97) was also below the 10-year average of 116 for the first two months of the offseason. And the market never warmed up.

But will Boras change his approach? Will teams be more aggressive with large-revenue clubs like the New York Yankees, New York Mets, Los Angeles Dodgers, and perhaps the Toronto Blue Jays and Boston Red Sox, seemingly incentivized to improve their rosters? And how will things change if Soto signs early, as the industry expects?

It'll be a fascinating offseason. Free-agent players as a whole need a rebound, and so, too, does the game's top agent.

Travis Sawchik is theScore's senior baseball writer.